Price Action Trading Course Learn Forex Price Action

Keys To Identifying And Trading The Head And Shoulders

Keys To Identifying And Trading The Head And Shoulders

in technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can predict a particular market movement. The recognition of the pattern is subjective and programs that are used for charting have to rely on predefined rules to match the pattern. There are 42 recognised patterns that can be split into simple and complex patterns.

candlestick Pattern Reliability. not all candlestick patterns work equally well. Their huge popularity has lowered reliability because they've been deconstructed by hedge funds and their algorithms. These well-funded players rely on lightning-speed execution to trade against retail investors and traditional fund managers who execute technical analysis strategies found in popular texts. In other words, hedge fund managers use software to trap participants looking for high-odds bullish or bearish outcomes. However, reliable patterns continue to appear, allowing for short- and long-term profit opportunities.

a Candlestick Pattern Head And Shoulder trader On Chart is a MetaTrader 4 plugin, and it comes as an Expert Advisor. You can attach it on up to 100 MT4 charts of any instrument or timeframe. but with Trader On Chart, you can trade easily right from the MT4 chart. That's because Trader On Chart allows you to preset your trade details like lot size, stop loss, take profit, breakeven point, trailing stop, etc.

Head And Shoulders Bottom Chartschool

Pola Head And Shoulders Valid Untuk Semua Time Frame

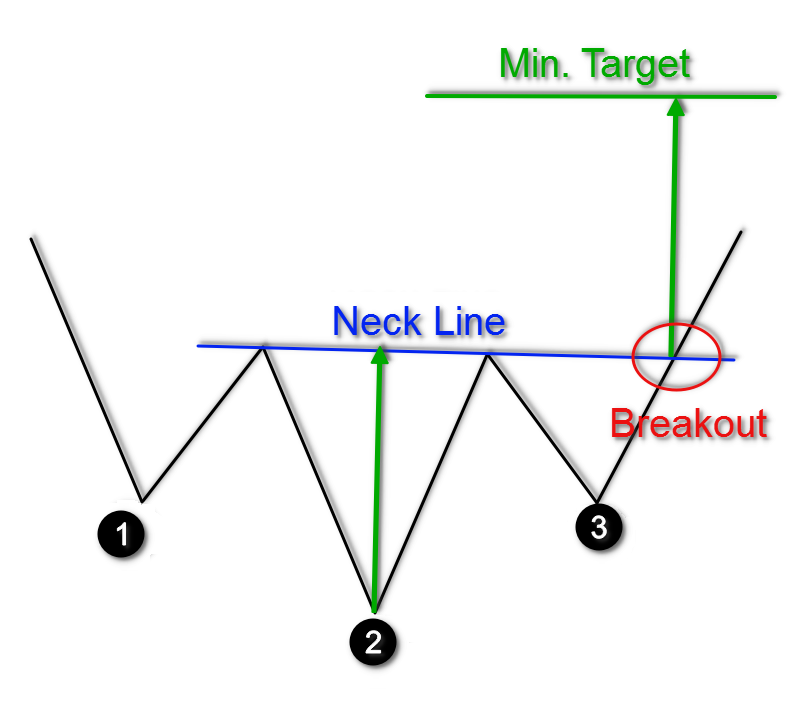

Tutorial How To Trade The Head Shoulders Pattern

candlestick pattern head and shoulder

Post a Comment

Post a Comment