The inverted hammer looks like an upside down version of the hammer candlestick pattern and when it appears in an uptrend is called a shooting star. It is important to note that the inverted pattern is a warning of potential price change not a signal in and of itself to buy.

What Is The Hammer Hanging Man Candlestick Pattern Quora

Inverted Hammer Candlestick Chart Pattern Set Of Candle

Jenis Jenis Pola Candlestick Lengkap

The inverted hammer is a type of candlestick pattern found after a downtrend and is usually taken to be a trend reversal signal.

Any lower and this candlestick would be considered a high wave candlestick indecisive. in technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can predict a particular market movement. The recognition of the pattern is subjective and programs that are used for charting have to rely on predefined rules to match the pattern. There are 42 recognised patterns that can be split into simple and complex patterns.

candlestick Pattern Reliability. Watch our video above to learn how to identify inverted hammers on stock charts. not all candlestick patterns work equally well. Their huge popularity has lowered reliability because they've been deconstructed by hedge funds and their algorithms. These well-funded players rely on lightning-speed execution to trade against retail investors and traditional fund managers who execute technical analysis strategies found in popular texts. In other words, hedge fund managers use software to trap participants looking for high-odds bullish or bearish outcomes. However, reliable patterns continue to appear, allowing for short- and long-term profit opportunities.

a Inverted Hammer Candlestick Pattern trader On Chart is a MetaTrader 4 plugin, and it comes as an Expert Advisor. You can attach it on up to 100 MT4 charts of any instrument or timeframe. Inverted hammer prior trend. but with Trader On Chart, you can trade easily right from the MT4 chart. That's because Trader On Chart allows you to preset your trade details like lot size, stop loss, take profit, breakeven point, trailing stop, etc.

Inverted hammer candlestick pattern. Trading the inverted hammer candlestick pattern. The appearance of an inverted hammer after a bearish trend denotes. Inverted hammer shooting star candlestick pattern can give very accurate trend reversal signs in a bullish or a bearish trend.

Inverted hammer candlestick pattern. A hammer is a candlestick pattern that indicates a price decline is potentially over and an. Inverted hammer candlesticks are bullish candlesticks patterns that form at the bottom of a downtrend which signals a potential reversal.

Like several other candlestick patterns hammer hanging man shooting star the inverted hammer is composed of only one candlestick but it needs support from surrounding candlesticks in order to exist. Also the sharp reversal from the high suggests rejection at that price and hints it could be a resistance level. These two candlestick varieties typically appear at the end of downtrending price action and are characterized by.

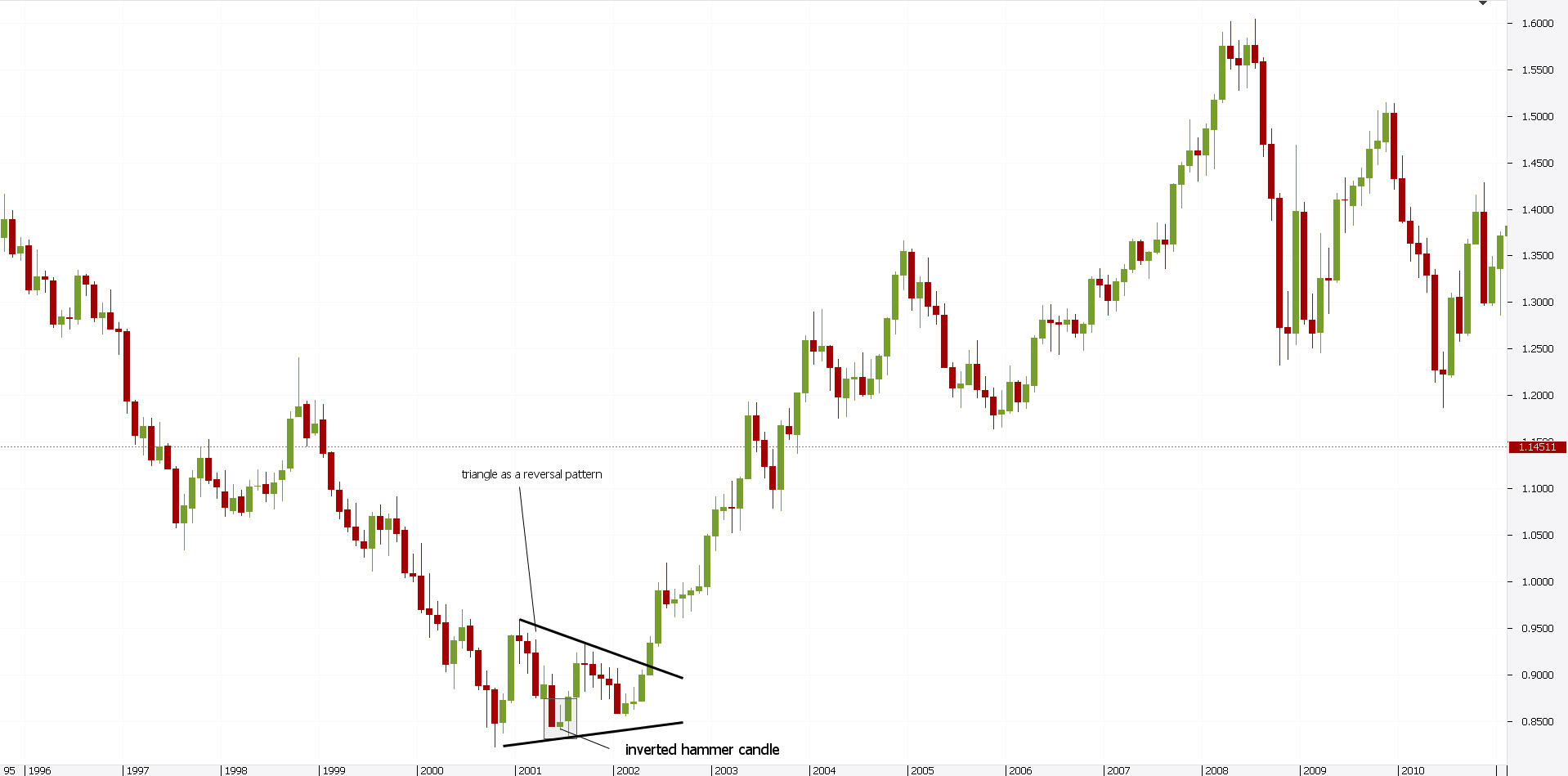

In the image below you will see a couple of inverted hammer candlestick patterns. The pattern has one candle. But forms in an uptrend.

Bearish continuation or bullish reversal. The hammer and inverted hammer candlestick patterns are two of the most common and easily identifiable reversal patterns in technical analysis of financial markets including for crypto traders. If youre trying to identify an inverted hammer candlestick pattern look for the following criteria.

Inverted hammer candlestick pattern. The length of the lower wick in the second example is on the limit of what i would consider acceptable. The inverted hammer candlestick formation occurs mainly at the bottom of downtrends and can act as a warning of a potential reversal upward.

The inverted hammer candlestick and shooting star patterns look exactly alike but are found in different areas. Has the exact shape of a shooting star. In technical analysis the inverted hammer candlestick pattern is the reverse of the hammer pattern.

The open close and low are. The inverted hammer also forms in a downtrend and represents a likely trend reversal or support.

Candlestick Patterns Crypto Connection

Most Popular Single Candlestick Patterns Let S Forex

Hammer Candlestick How To Trade The Most Powerful Reversal

inverted hammer candlestick pattern

Post a Comment

Post a Comment