A dark cloud cover after a sharp decline or near new lows is unlikely to be a valid bearish reversal pattern. Bearish reversal patterns within a downtrend would simply confirm existing selling pressure and could be considered continuation patterns.

How To Trade Cryptocurrency Candlestick Patterns Like A Pro

Harami Inside Day Candlestick Pattern Bullish Harami

Abandoned Baby Candlestick Pattern Best Forex Brokers For

Candlestick patterns should fit within a trading strategy and not to be traded upon solely.

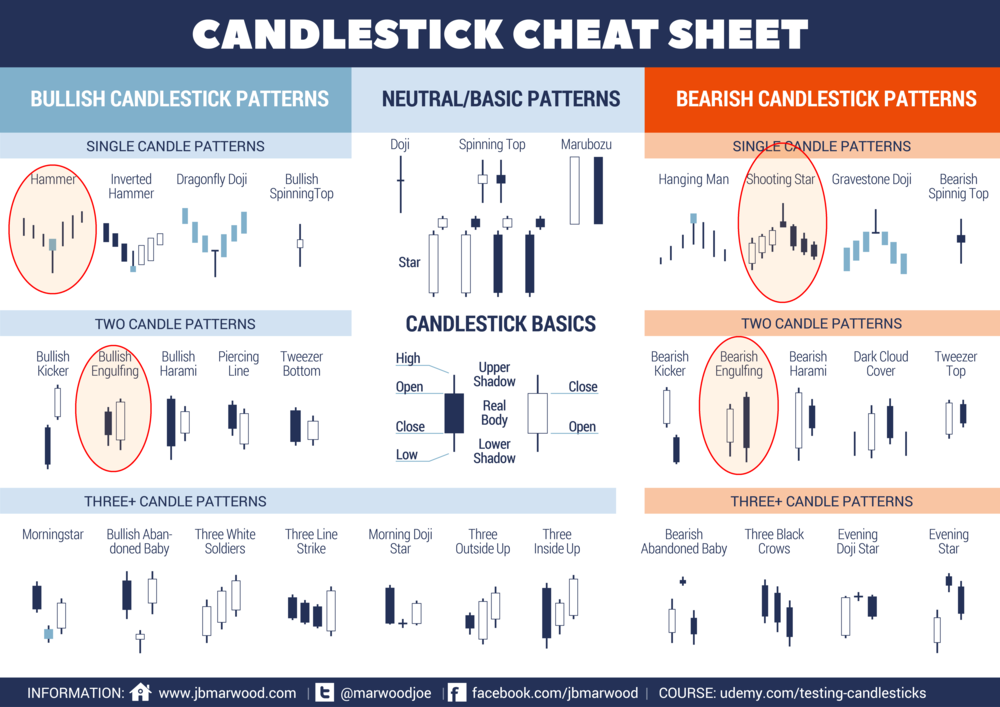

The doji candle is one of the most popular candlestick reversal patterns and its structure is very easy to recognize. in technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can predict a particular market movement. The recognition of the pattern is subjective and programs that are used for charting have to rely on predefined rules to match the pattern. There are 42 recognised patterns that can be split into simple and complex patterns.

candlestick Pattern Reliability. In a bearish engulfing there is first a white bodied candle. not all candlestick patterns work equally well. Their huge popularity has lowered reliability because they've been deconstructed by hedge funds and their algorithms. These well-funded players rely on lightning-speed execution to trade against retail investors and traditional fund managers who execute technical analysis strategies found in popular texts. In other words, hedge fund managers use software to trap participants looking for high-odds bullish or bearish outcomes. However, reliable patterns continue to appear, allowing for short- and long-term profit opportunities.

a Candlestick Pattern Trend Reversal Candles trader On Chart is a MetaTrader 4 plugin, and it comes as an Expert Advisor. You can attach it on up to 100 MT4 charts of any instrument or timeframe. An engulfing is a two candle pattern that can signal a major reversal at market extremes. but with Trader On Chart, you can trade easily right from the MT4 chart. That's because Trader On Chart allows you to preset your trade details like lot size, stop loss, take profit, breakeven point, trailing stop, etc.

Candlestick pattern trend reversal candles. First the doji is a single candle pattern. If the price pullback towards resistance then wait for a bearish reversal candlestick pattern. Use candlestick patterns to trade in the direction of the underlying trend not against it.

This pattern does not mean much as it could be a pause before price continues or it could be the beginning of a trend change. There are many methods available to determine the trend. If theres a bearish reversal candlestick pattern then make sure the size of it is larger than the earlier candles signalling strong rejection if theres a strong price rejection then go short on next candles open.

While many people try to trade dojis the fact is they dont show if there is strength or weakness. The hammer and inverted hammer were covered in the article introduction to candlesticksthis article will focus on the other six patterns. The hammer is a bullish reversal pattern which signals that a stock is nearing bottom in a downtrendthe body of the candle is short with a longer lower shadow which is a sign of sellers driving.

Top candlestick reversal patterns. Only when it occurs at a support or resistance level would it have some potential as a reversal candle. Therefore before outlining my top forex reversal candlestick patterns let me introduce a few rules on how to use them.

Before moving on to individual patterns certain guidelines should be established. And vice versa for long. We will start with four of the most popular and effective candlestick reversal patterns that every trader should know.

The bullish three line strike reversal pattern carves out three black candles within a downtrendeach bar posts a lower low and closes near the intrabar low. For a complete list of bullish and bearish reversal patterns see greg morris book candlestick charting explained.

Technical Analysis How To Use Advanced Triple Candlestick

Mastering And Understanding Candlesticks Patterns

Candlestick Charts For Day Trading How To Read Candles

candlestick pattern trend reversal candles

Post a Comment

Post a Comment