The first is a tall white real body the second is a small real body white or black that gaps above the first real body to form a star and the third is a black candlestick that closes well into the first sessions white real body. The pattern occurs at the top of a trend or during an uptrendthe name hanging man comes from the fact that the candlestick looks somewhat like a hanging man.

Candlestick Recognition Master Forex Indicator

Complete Price Action 40 Candlestick Pattern Book Tani Forex

Why Candlestick Pattern Is Important In The Stock Market

The second candles body should be bigger than the first candle and should close at or very near its low.

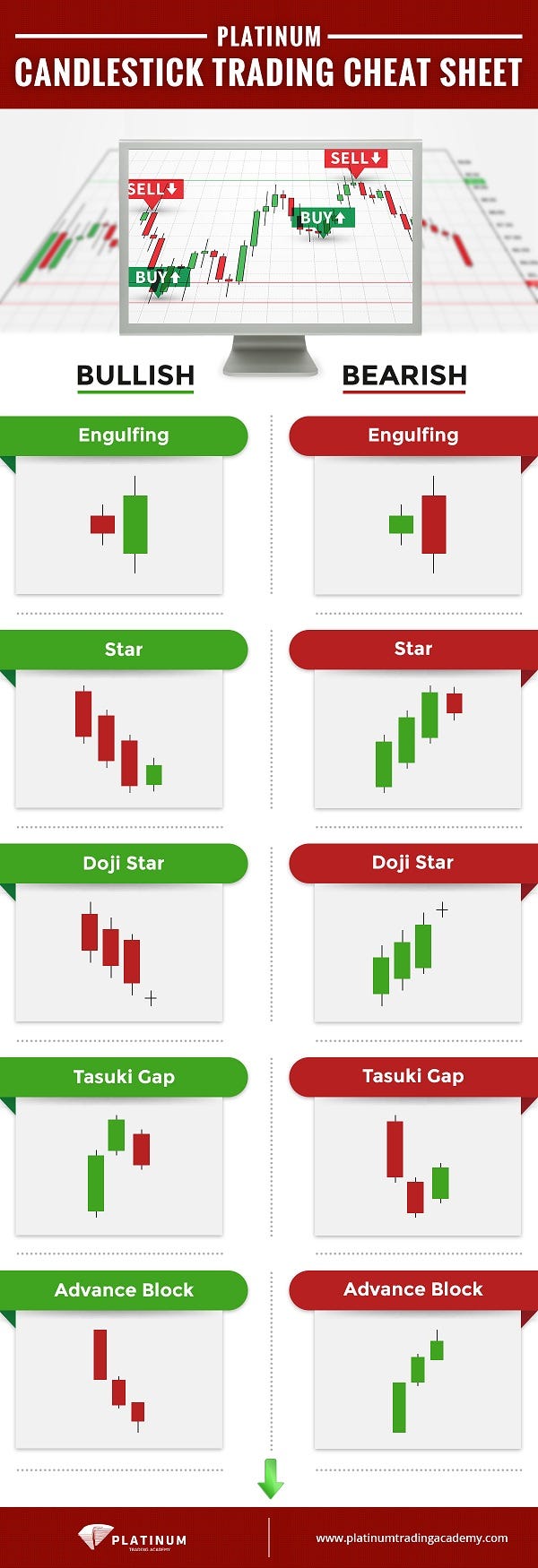

It is formed when three bearish candles follow a strong uptrend indicating that a reversal is in the works. in technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can predict a particular market movement. The recognition of the pattern is subjective and programs that are used for charting have to rely on predefined rules to match the pattern. There are 42 recognised patterns that can be split into simple and complex patterns.

candlestick Pattern Reliability. Look for a white candlestick to close above the long black candlesticks open. not all candlestick patterns work equally well. Their huge popularity has lowered reliability because they've been deconstructed by hedge funds and their algorithms. These well-funded players rely on lightning-speed execution to trade against retail investors and traditional fund managers who execute technical analysis strategies found in popular texts. In other words, hedge fund managers use software to trap participants looking for high-odds bullish or bearish outcomes. However, reliable patterns continue to appear, allowing for short- and long-term profit opportunities.

a Candlestick Pattern Forex trader On Chart is a MetaTrader 4 plugin, and it comes as an Expert Advisor. You can attach it on up to 100 MT4 charts of any instrument or timeframe. In the next following sections we will take a look at specific japanese candlestick pattern and what they are telling us. but with Trader On Chart, you can trade easily right from the MT4 chart. That's because Trader On Chart allows you to preset your trade details like lot size, stop loss, take profit, breakeven point, trailing stop, etc.

Candlestick pattern forex. Bearish belt hold is a single candlestick pattern. It is a single candlestick pattern that has a long lower shadow and a small body at or very near the top of its daily trading range. Candlestick trading is the most common and easiest form of trading to understand.

The three black crows candlestick pattern is just the opposite of the three white soldiers. The best candlestick pdf guide will teach you how to read a candlestick chart and what each candle is telling you. A top reversal pattern formed by three candle lines on a japanese candlestick chart.

The forex reversal is an advanced mt4 forex indicator developed to assist traders seeking trend changes in the currency markets without any repainting nor lagging. Best candlestick pdf guide bankers favorite fx pattern.

Forex Candlestick Patterns The Good Stuff Foremasteryhq

Forex Candlestick Patterns Basics Key Information You Need

Forex Candlestick Pattern Indicator V1 5 Metatrader 4

candlestick pattern forex

Post a Comment

Post a Comment